The Perpetual Income Stream: Modeling Tax-Advantaged Retirement Using ROC Dividends (STRC Case Study)

Abstract

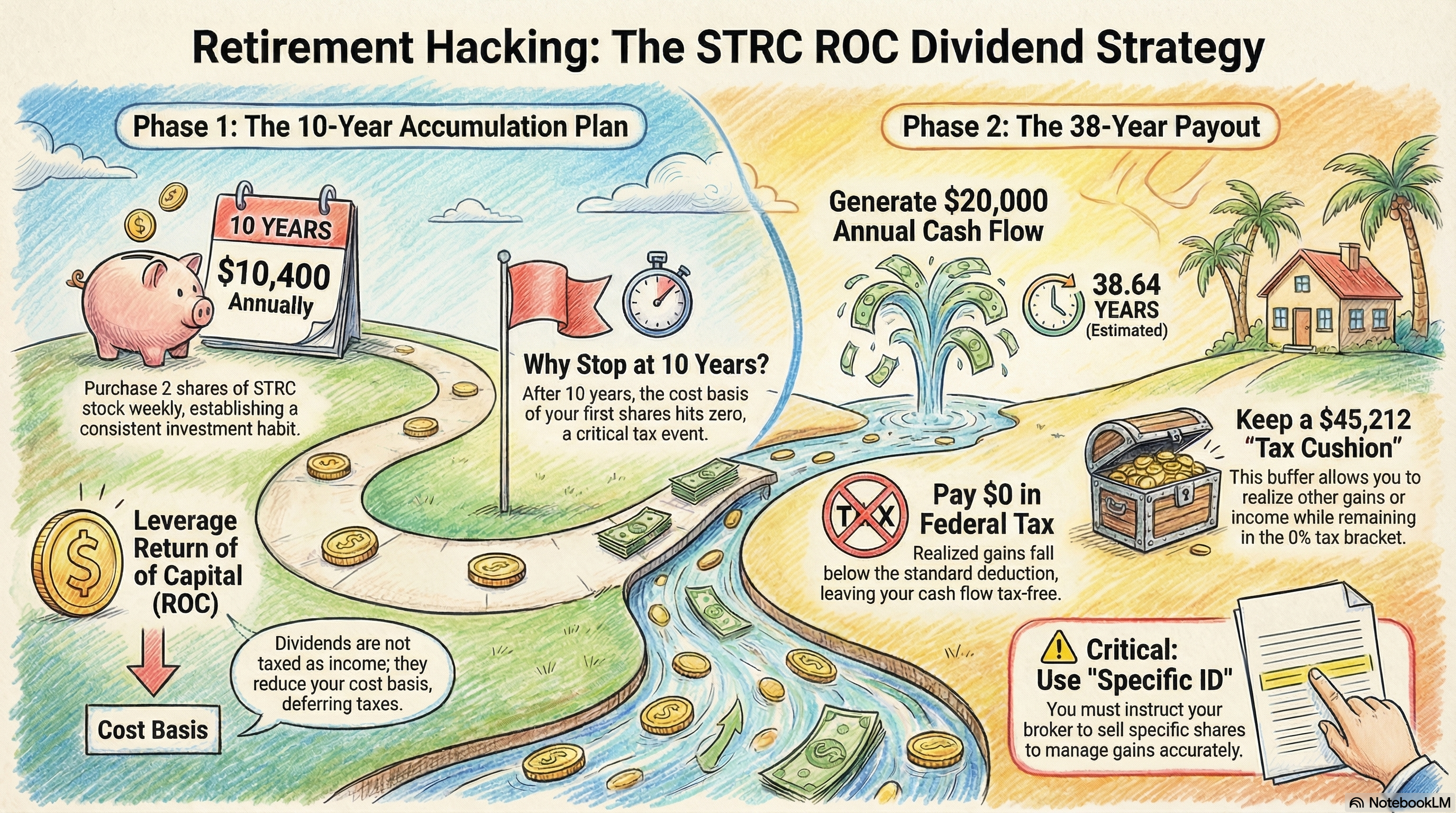

This paper models the strategic use of Return of Capital (ROC) distributions from the specific, perpetual preferred stock STRC (Strategy, Inc.) to create a long-lasting, tax-free base income stream in retirement. A cautious 10-year investment plan is modeled for a couple aged 57 to 67, motivated by the mathematically critical moment when the first lot's cost basis hits zero. The model projects that an annual USD 10,400 investment (2 shares weekly) yields a USD 20,000 annual cash flow for nearly 38.64 years. This strategy preserves a significant portion of the investor's tax-free capital gains limit, providing a large margin for realizing taxable gains from other assets without incurring federal tax liability.

1. Introduction and Strategic Motivation

In retirement, managing tax liability on withdrawals is paramount. This study explores a specific, highly tax-efficient strategy leveraging ROC distributions from a high-yield, perpetual security, exemplified by the preferred stock of STRC (Strategy, Inc.) [1].

1.1. Rationale for Cautious Investment in STRC

The investment strategy is intentionally cautious due to the security's structure and the novelty of its perpetual nature:

- New Security Model: STRC is a relatively new security compared to traditional REITs or CEFs. Adopting a cautious strategy is prudent, as its long-term resilience and perpetual nature must be verified over time.

- Verifying Claims: While the claims regarding its ROC nature are mathematically verifiable (given the company's tax profile), prudent planning acknowledges the risk that real-world outcomes may deviate from projections.

1.2. The Goal: A Risk-Free, Tax-Free Base Income

The primary goal is to establish a risk-managed, tax-free base income stream of USD 20,000 per year that lasts for nearly 40 years. This base stream allows the investor to:

- Build Muscle Memory: The recommended weekly cadence of purchasing 2 shares helps establish consistent investment habits.

- Preserve Tax Shield: The income stream is engineered to be highly tax-efficient, providing a large cushion (USD 63,350 - USD 18,137) for strategically selling other assets that would generate taxable income.

2. Methodology and Model Assumptions

We model a 10-year investment period (120 months) for a couple approaching retirement (e.g., ages 57 to 67), filing Married Filing Jointly (MFJ).

2.1. The Critical 11th Year Constraint

The 10-year investment plan is deliberately capped because, assuming a fixed 10% annual ROC, the cost basis of the very first investment lot would be reduced to USD 0.00 around the 11th year of holding (10 years of distributions).

Capping the accumulation phase at 10 years simplifies planning and manages this critical tax event.

2.2. Simplifying Assumptions

The model assumes a constant USD 100.00 share price and a constant 10% annual ROC rate. It is acknowledged that in the real world, the variable price and dividend rate of STRC will fluctuate.

2.3. Tax Parameters (Proxy 2024 Figures for MFJ, both 65+) [2]

| Parameter | Symbol | Value |

|---|---|---|

| Standard Deduction (SD) | USD 30,700 | |

| 0% LTCG Threshold | USD 94,050 | |

| Taxable Gain Goal (Max Shield) | USD 63,350 |

The maximum taxable gain the investor can realize while paying USD 0 federal tax is:

3. Computational Model (Python/Pandas)

The following computational logic was used to simulate the cost basis adjustments, DRIP compounding, and the final lot-wise sales plan. The model verifies that the USD 20,000 annual cash flow requires the sale of 200.00 shares annually, realizing a taxable gain of USD 18,137.53.

# Core Python Logic for Cost Basis and Sales Simulation

import pandas as pd

import numpy as np

# --- FIXED PARAMETERS ---

SALE_PRICE = 100.00

ROC_annual = 10.00

ROC_m = ROC_annual / 12 # Monthly ROC per share

T_months = 120 # Total months (10 years)

T_weeks = 520 # Total weeks

S_w = 2 # Shares purchased weekly

# --- 1. Monthly Simulation (DRIP Compounding) ---

# Total shares at retirement: 1,747.69

# --- 2. LOT-WISE SALES PLAN LOGIC for USD 20,000 Cash Flow ---

TARGET_SALES_PROCEEDS = 20000

# The simulation identifies the 200 lowest-ACB shares required to hit this cash target.

# (Iteration over pre-sorted df_all_lots to hit TARGET_SALES_PROCEEDS)

# This results in: total_shares_sold = 200.00; total_gain_realized = 18,137.53

# --- 3. LONGEVITY CALCULATION (Recursive Estimate) ---

# ANNUAL_SHARES_SOLD = 200.00

# DRIP_SHARES_ACQUIRED = (1747.69 - 200.00) * 0.10 = 154.77

# NET_DEPLETION = 200.00 - 154.77 = 45.23

# REVISED_LONGEVITY = 1747.69 / 45.23 ≈ 38.64 years

4. Strategic Tax-Free Base Income

The primary goal is met by establishing a fixed, tax-free base income stream:

| Metric | Result (MFJ, 65+) |

|---|---|

| Base Annual Cash Flow Target | USD 20,000.00 |

| Total Annual Taxable Gain Realized | USD 18,137.53 |

| Federal Tax Due | USD 0.00 |

| Portfolio Longevity Estimate | 38.64 years |

4.1. The Remaining Tax Cushion

The base income stream utilizes only a small portion of the total available tax shield, providing a large buffer for managing other retirement assets:

The investor can realize an additional USD 45,212 in taxable income annually (e.g., from selling other assets or receiving pension income) and still maintain a USD 0 federal tax liability.

4.2. Scaling the Income Stream

If more income is desired, the investor can simply increase the weekly lot size during the accumulation phase (e.g., from 2 shares to 3 or 4 shares). This is recommended over reducing the investment period, as the weekly cadence builds better investment habits.

5. Tax Reporting and Record-Keeping Responsibilities ⚠️

Absolute caution is required. The investor must use Specific Identification (Spec ID) when selling shares and verify the accuracy of the Adjusted Cost Basis (ACB) reported by the broker on Form 1099-B, which must account for the ROC reduction [3].

6. Conclusion

The model demonstrates that a prudent, short-term (10-year) investment in a perpetual ROC-returning security like STRC can establish a powerful USD 20,000 annual tax-free cash flow that lasts nearly four decades. This strategy accomplishes two essential retirement goals: securing a non-taxable base income and preserving a significant USD 45,212 tax cushion for managing other income streams and asset sales.

Disclaimer: This paper does not constitute tax advice. The reader must consult with a qualified tax professional to apply these principles to their specific financial and tax situation.

7. References

- Internal Revenue Service (IRS). IRS Publication 550, Investment Income and Expenses. Available at: https://www.irs.gov/publications/p550

- Internal Revenue Service (IRS). Tax Year 2024 Tax Brackets and Standard Deductions. Available at: https://www.irs.gov/newsroom/irs-provides-tax-inflation-adjustments-for-tax-year-2024

- Internal Revenue Service (IRS). IRS Publication 551, Basis of Assets. Available at: https://www.irs.gov/publications/p551