Financial Fortress: Strategy Inc.'s 1.44 Billion USD Reserve and the Evolution of Digital Credit

I. Introduction: The Strategic Evolution of Strategy Inc.

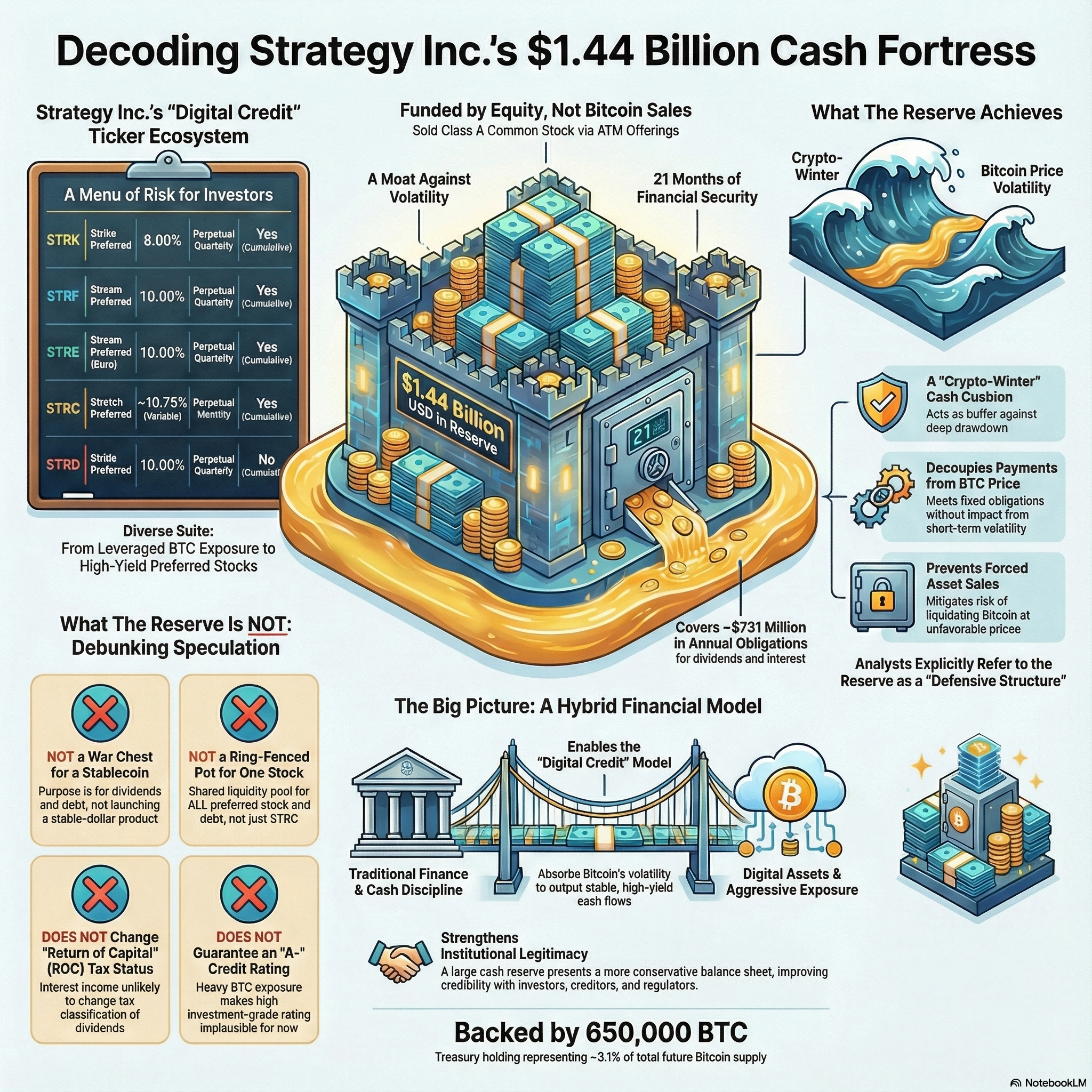

In December 2025, Strategy Inc. (formerly MicroStrategy Incorporated) executed a financial maneuver of profound significance, announcing the creation of a 1.44 billion U.S. dollar reserve. Designated explicitly as a “USD Reserve,” this substantial fund was established with a singular, crucial mandate: to secure dividend payments on its growing portfolio of preferred stock and to meet interest obligations on its outstanding debt. This action represents a fundamental pivot in the corporate strategy of the company, signaling a transformation from an aggressive, pure accumulation model of Bitcoin treasury to a more sophisticated, hybrid entity that balances volatile digital asset exposure with disciplined, conservative cash management.

The establishment of this 1.44 billion USD financial fortress is not merely a tactical liquidity management decision; it is the cornerstone of Strategy Inc.’s emerging role as the world's leading issuer of “Digital Credit”. By securing nearly two years of fixed liabilities—specifically, a 21-month horizon of dividend and interest coverage—the company has effectively decoupled its ability to service its yield-bearing instruments from the short-term fluctuations of the Bitcoin market. In the context of the larger narrative surrounding corporate Bitcoin holdings and crypto treasuries, this move by Strategy Inc. may mark a decisive turning point, establishing a model that emphasizes both substantial digital asset exposure and robust, traditional liquidity discipline.

The narrative begins with a significant corporate rebranding. In a definitive step to align its identity with its primary operational focus—the acquisition and securitization of Bitcoin—MicroStrategy Incorporated underwent a legal name change and comprehensive rebranding to Strategy Inc.. This strategic move, along with the development of a complex, diversified capital structure and the implementation of the massive USD Reserve, positions Strategy Inc. as a unique bridge between traditional fiat capital markets and the burgeoning digital asset economy. The ultimate goal of this financial engineering is clear: to ensure the survival and long-term sustainability of the firm’s primary directive, which is the relentless accumulation of Bitcoin accretion per share.

II. The Strategic Paradigm Shift and Rebranding

Strategy Inc.’s transformation is rooted in a fundamental change in corporate identity and mandate. The rebranding from MicroStrategy Incorporated to Strategy Inc. was far more than a cosmetic change; it aligned the corporate identity with its operational focus and ticker symbols (STRF, STRC, STRK, STRD). The company now explicitly positions itself as the "world's first and largest Bitcoin Treasury Company" and a leading issuer of "Digital Credit".

The name “Strategy” reflects a simplification and elevation of the company’s mandate, focusing on the singular directive of Bitcoin accumulation. Dropping “Micro” suggests a macro-economic scope, indicating that the firm views its balance sheet as a macro-hedge instrument. This semantic shift is supported by a new visual identity, including the Bitcoin logo and the orange brand color, cementing the company’s allegiance to the digital asset network and signaling to the market that its destiny is intrinsically linked to Bitcoin’s performance. Executive leadership, including Founder Michael Saylor and CEO Phong Le, have articulated this vision of a financial entity acting as a primary protagonist in the global financial system.

This new positioning enables the concept of “Digital Credit”. Strategy Inc. acts as a transformer, borrowing fiat currency through debt and preferred instruments from the traditional economy and then “lending” this value to the Bitcoin network by accumulating and holding 650,000 BTC. The underlying financial arbitrage relies on the expectation that the appreciation rate of Bitcoin will significantly exceed the cost of the fiat capital borrowed (which ranges from 0% on some converts to 8–10% on preferred stocks).

To facilitate this complex model, Strategy Inc. utilizes a specialized capital structure known as the Ticker Ecosystem. This system allows Strategy Inc. to tap into diverse pools of global capital, segmenting its risk offerings.

- MSTR (Legacy Class A Common Stock): This instrument serves as the leveraged Bitcoin play, offering investors exposure to volatility and capital appreciation. Critically, MSTR’s sale via "at-the-market" (ATM) offerings is the primary source of funding for the 1.44 billion USD Reserve.

- Preferred Stocks (STRF, STRC, STRK, STRD, STRE): These instruments provide high-yield fixed income, appealing to more conservative or income-seeking investors. This segmentation is intentional, allowing management multiple levers to manage capital based on market conditions and investor demand.

III. The Mechanics and Funding of the USD Reserve

The 1.44 billion USD Reserve, announced in December 2025, serves as the critical shock absorber for Strategy Inc.’s sophisticated financial machine. The primary concern critics have long levied against the company’s high-leverage Bitcoin strategy is liquidity risk: the possibility that a sustained crypto market downturn could impair the ability to service obligations, potentially forcing a liquidation of Bitcoin holdings. The reserve directly addresses this existential danger.

The Purpose and Composition

The reserve is a shared liquidity pool, explicitly designated to cover "dividends on its preferred stock(s)" (plural) and "interest on outstanding indebtedness". It is not ring-fenced for any single preferred class.

The reserve functions as a crucial "Cash-backstop" complementing Strategy’s massive Bitcoin Treasury (holding 650,000 BTC as of the latest announcement). The stated purpose is to decouple dividend and debt obligations from short-term Bitcoin price volatility, thus avoiding forced BTC sales during a down cycle, often referred to as a “crypto-winter”. If Bitcoin were to crash hard, perhaps down to 20,000 USD or lower, and capital markets dried up, Strategy Inc. would not be forced to sell its BTC immediately. Instead, it could draw down the USD Reserve, granting the company time to navigate illiquid markets, maintain its digital-credit narrative, and avoid panic sells. Multiple sources refer to this reserve explicitly as a “moat” or “cash wall,” mitigating liquidity risk and forced-asset-sale risk.

While the exact instruments are not fully detailed, the reserve will presumably be parked in safe, short-term instruments, such as U.S. Treasury bills or money-market equivalents. Holding large amounts of cash equivalents, rather than being 100% in Bitcoin, also provides a strategic benefit: it helps Strategy present a conservative, risk-buffered balance sheet, enhancing its credibility with creditors, investors, and regulators.

The Funding Mechanism: ATM Arbitrage

The reserve was not funded through operational cash flow or by selling Bitcoin. Instead, Strategy Inc. raised the reserve by selling Class A common stock (MSTR) under its existing at-the-market (ATM) offering program. This funding mechanism highlights a sophisticated use of capital markets arbitrage.

The mechanism operates because Strategy Inc.’s common stock typically trades at a significant premium to the Net Asset Value (NAV) of its underlying Bitcoin holdings. The market values the company’s ability to acquire Bitcoin accretively and its volatility structure. By selling MSTR shares at this premium and retaining the proceeds as US Dollars, the company captures cash. This cash is then designated to pay the yield on preferred stock, which typically trades near par value.

This process effectively means Strategy Inc. is monetizing the volatility and premium of its common equity to secure the stability of its fixed-income liabilities. Existing common shareholders accept a degree of dilution in exchange for the structural stability provided by the reserve, which protects the core Bitcoin stack from forced liquidation—an outcome that would be detrimental to common shareholders in the long run. The company has framed this as a necessary cost of capital, an "insurance premium" paid to ensure the long-term sustainability of the platform.

IV. The 21-Month Financial Fortress: Validating the Coverage

A key announcement regarding the reserve was the specific duration it covers: “currently covers 21 months of dividend and interest obligations,” with a stated long-term goal of extending coverage to 24 months or more. This 21-month figure is vital because it represents a calculated runway that historically exceeds the duration of a typical Bitcoin bear market cycle, providing substantial financial stability.

The Mathematics of Coverage

The official validation of the 21-month claim requires an examination of Strategy Inc.’s annualized fixed obligation run rate. As of late 2025, the total annualized interest and dividend obligations were reported to be approximately 731 million USD. This figure incorporates the cost of servicing convertible notes, as well as the dividends for all preferred stock classes (STRF, STRC, STRK, STRD, and STRE).

The annualized obligation of 731 million USD translates to a monthly obligation of roughly 61 million USD (731 million USD divided by 12).

Using the disclosed reserve size and the calculated monthly burn rate:

While the raw calculation yields approximately 23.6 months of coverage, the company’s official claim is 21 months. This conservative claim likely accounts for several prudential factors:

- Projected Issuance: Management likely anticipates future preferred stock issuances, which would increase the monthly dividend burden and reduce the duration coverage of the fixed reserve amount.

- Operational Buffers: Standard corporate practice dictates retaining a portion of such large reserves for unallocated contingencies, working capital fluctuations, or transaction costs.

- Floating Rate Assumptions: The "Stretch" (STRC) preferred stock utilizes a variable dividend rate. Conservative modeling likely assumes potential interest rate increases, which would raise the servicing cost of this instrument and shorten the effective coverage period.

The 1.44 billion USD reserve, therefore, serves as a mechanism that allows the firm to maintain its commitments to credit investors even if Bitcoin experiences significant turbulence, as recently demonstrated by a 28% price drop (111,612 USD to 80,660 USD) in under a month in late 2025. This massive cash buffer ensures the likelihood of a skipped payment is statistically low in the medium term.

V. The Ecosystem of Fixed Obligations: Strategy Inc.'s Liability Structure

The necessity for such a large reserve is driven by the sheer scale and complexity of Strategy Inc.’s liability structure, particularly its preferred stock portfolio, designed to appeal to investors seeking digital asset exposure paired with fixed-income reliability.

The total annual obligation of approximately 731 million USD is massive, especially when viewed against the context of the company’s operating income from its legacy software business (which is valuable, but insufficient to cover the liability). The components of this obligation are detailed in the sources:

- STRC Dividends: ~294 Million USD (The largest single component due to high volume and variable rate).

- STRF Dividends: ~125 Million USD.

- STRD Dividends: ~125 Million USD.

- STRK Dividends: ~111 Million USD.

- STRE Dividends: ~40 Million USD (Pro forma).

- Convertible Debt Interest: ~35 Million USD (Remarkably low due to 0% or near-zero coupons).

Detailed Preferred Stock Classes

1. Series A Perpetual Strike Preferred Stock (STRK): This stock acts as a core component of the company's fixed-income offerings.

- Rate: Fixed at 8.00% per annum.

- Structure: Perpetual and Cumulative. The cumulative feature provides a strong layer of protection: if dividends are suspended, the unpaid amounts accrue and must be paid before common shareholders receive any dividends.

- Context: A January 2025 offering of 7.3 million shares raised approximately 563 million USD, indicating robust institutional appetite for high-yield paper backed by the Strategy Inc. balance sheet.

2. Series A Perpetual Stream Preferred Stock (STRF / STRE): Designed for global reach, this series is issued in US Dollars (STRF) and Euros (STRE).

- Rate: 10.00% per annum.

- Diversification: The Euro-denominated STRE, listed on the Luxembourg Stock Exchange (LuxSE), allows the company to access European capital markets and hedges currency risk, broadening its investor base. The 10% coupon is higher than STRK’s 8%, potentially reflecting different issuance conditions.

3. “Stretch” Preferred Stock (STRC): The STRC instrument is highly innovative, branded as "Short Duration, High Yield Credit".

- Rate: Variable, adjusted monthly (recent filings cite approximately 10.75% annualized).

- Mechanism: The dividend rate is recalibrated monthly to encourage the security to trade around its 100 USD par value, effectively stripping away price volatility. This mechanism appeals to investors prioritizing principal stability.

- Frequency: Dividends are payable monthly, appealing to cash-flow-focused investors. It is also Cumulative.

4. Series A Perpetual Stride Preferred Stock (STRD): STRD introduces a specific risk/reward profile.

- Rate: 10.00% per annum.

- Structure: Non-cumulative. This is the critical distinction: if the Board skips a payment, the obligation vanishes and does not accrue.

- Compensation: The high 10% coupon compensates for the lack of legal accumulation protection. For STRD holders, the existence of the 21-month reserve is particularly vital, as it drastically lowers the statistical probability of a missed payment in the medium term, despite the non-cumulative structure.

Convertible Debt Profile

Strategy Inc. complements its preferred stock with convertible senior notes, favoring instruments with zero or low coupons. The total interest expense on this convertible debt is low, approximately 35 million USD annually. For instance, a 2 billion USD offering of 0% convertible senior notes due 2030 was completed in February 2025. This structure costs the company nothing in cash flow terms unless the stock price rises significantly, resulting in conversion to equity. The company actively manages its debt ladder, demonstrated by the proactive redemption of 1.05 billion USD of its 2027 notes in January 2025, rolling obligations into longer-term instruments.

The 1.44 billion USD reserve, while mostly dedicated to preferred dividends, explicitly covers debt interest as well. This coverage mandate is legally significant, effectively eliminating the risk of default on interest payments for years, thus likely improving the company’s credit rating and lowering its cost of future borrowing.

VI. Credit, Regulatory, and Market Implications of the Reserve

The establishment of the large, durable cash reserve materially improves Strategy Inc.’s liquidity profile and capacity to meet fixed obligations. This is inherently credit-positive.

Credit Rating Enhancement

The reserve reduces the likelihood of short-term distress, leading to enhanced credit standing. Realistically, the sources suggest that the company could plausibly jump from a deep-junk rating (B−) toward upper junk or lower speculative grade (BB− → BB → BB+). In a best-case scenario, combining the reserve with disciplined financial policy could allow Strategy Inc. to inch into lower investment-grade territory (BBB−).

However, the leap to a high investment-grade rating like A− remains implausible. This limitation stems from the fundamental risk structure: the company remains heavily exposed to the volatility of Bitcoin and lacks stable, recurring earnings independent of crypto movements. The reserve enhances liquidity and short-term solvency but does not rewrite the company’s core reliance on digital assets.

Tax and Yield Implications (ROC Classification)

Because the 1.44 billion USD reserve will generate interest income from short-term safe assets like U.S. Treasury bills, this income will add to the company’s cash flow. This cash flow can be used for reserve replenishment or towards dividends.

However, the sources confirm that this interest income is unlikely to be sufficient to change the "Return of Capital (ROC)" classification for preferred dividends. The ROC classification depends not on cash flow but on the company’s earnings and profits (Earnings and Profits)—taxable income. Since the core of Strategy’s business remains long-term BTC holdings (which do not produce recurring taxable income unless sold), the interest yield from the reserve improves liquidity but does not meaningfully alter the ROC classification under the current business structure.

Debunking Market Misinterpretations

The company’s strategy has often been subjected to misinterpretation by investors and market commentators. The sources address two key areas of speculation:

-

Stable-Dollar/Stable-Coin Issuance: Market speculation arose, partly based on executive tweets mentioning “green dots,” that Strategy Inc. might be hinting at a stable-dollar launch. However, based on public statements and filings, the reserve was explicitly described only as a mechanism to support existing dividends and debt interest. There is currently no credible indication that Strategy plans to enter the stable-dollar business, use the reserve as a war-chest for this purpose, or engage in yield farming. While some commentators speculate the company could seek higher yield by placing cash into crypto-native yield vehicles, such moves would carry additional risks, and nothing publicly binds Strategy Inc. to do so.

-

The "Green Dots": The supposed signal of a new product or stable-dollar issuance—the “green dots / green line” on a BTC-holding chart—was clarified by analysts. It does not reflect forward-looking commentary. Rather, the green line reflects Strategy’s rolling average purchase price / cost basis for Bitcoin. The "green" line only updates, or a "green dot" appears, when there is a new BTC acquisition; it does not track market price or expected future buys.

Institutional Legitimacy and Regulatory Friction

Strategy Inc.’s decision to hold large amounts of cash and U.S. Treasuries offers a crucial, often-overlooked strategic benefit. For a public company with high institutional and regulatory visibility, a large cash reserve presents a conservative, risk-buffered balance sheet.

This presentation may improve the company’s credibility with regulators and make Strategy Inc. more palatable as an issuer of “digital-credit” products or potential regulated offerings in jurisdictions with more conservative financial regulations (e.g., the EU). The combination of a vast BTC position (650,000 BTC) and a visible, substantial cash buffer provides Strategy Inc. with a hybrid identity: both aggressive in crypto accumulation and conservative in liquidity. In effect, the reserve strengthens the company’s institutional legitimacy, potentially smoothing regulatory friction and creating optionality for future non-crypto financial products.

VII. Sustainability and Risk Factors

The 1.44 billion USD reserve is a powerful buffer, but it is not a foundation for the long term. The long-term business risk remains open unless Strategy Inc. develops recurring non-BTC cash flows from operations or products.

Financial Dependency and Sustainability of Yield

The sustainability of the Digital Credit model hinges on the ability to continuously maintain the reserve or raise capital efficiently. The company does not generate sufficient operating income from its legacy software business to cover the 731 million USD annual dividend and interest obligation. Therefore, the dividend payments are structurally dependent on two factors:

- External Capital Raising: Issuance of new debt or, most critically, equity (ATM offerings).

- Bitcoin Appreciation: The high valuation premium on MSTR stock is linked to the success of the Bitcoin accumulation strategy.

The critical risk factor here is the sustainability of the Strategy Premium. If Bitcoin were to enter a multi-year bear market lasting longer than the 21-month reserve coverage, and if the MSTR stock premium were to evaporate, the ability to raise new equity to replenish the reserve vanishes. If MSTR stock trades at Net Asset Value (NAV)—meaning no premium—issuing stock to pay a 10% dividend becomes highly dilutive and destroys shareholder value. The entire hybrid model relies on the perpetual existence of a market valuation premium for Strategy Inc. above the value of its Bitcoin holdings.

Dilution Risk and Governance Trade-Off

The funding mechanism—selling Class A common stock via ATM—is inherently dilutive to existing common shareholders. The dilution occurs because the company is selling shares to acquire US Dollars (cash) rather than immediately acquiring Bitcoin, which is the core mandate. Management justifies this short-term dilution as the necessary cost of capital—the "insurance premium"—to ensure structural stability.

This financial move also introduces a key governance trade-off that remains open: Management must continually decide whether to allocate incoming cash to reinforce the dividend reserve, hike Bitcoin holdings, or reinvest in other areas of the business.

Regulatory Risk and Identity Blurring

As Strategy Inc. evolves, its identity blurs the line between a traditional operating company and a specialized financial holding company. The sheer scale of its passive Bitcoin holding (650,000 BTC) and the issuance of a diverse portfolio of financial securities (STRF, STRC, STRD, etc.) could potentially attract scrutiny under the Investment Company Act of 1940. The rebranding to "Strategy Inc" and the explicit issuance of "Digital Credit" may prompt regulators to view the entity as a de facto exchange-traded fund (ETF) or bank, which could subject it to stricter capital requirements and supervision. The reserve’s holding of U.S. Treasuries does help mitigate this risk by presenting a conservative image, but the core regulatory exposure remains due to the nature of its assets and liabilities.

VIII. Conclusion: The Hybrid Entity and the Value of Time

The establishment of Strategy Inc.’s 1.44 billion USD Reserve, sourced from the premium valuation of its common equity, is arguably the most significant financial development since the company began its Bitcoin accumulation strategy. This reserve serves as a concrete, 1.44 billion USD fund, confirmed via common-stock sales, providing a 21-month cushion against short-term volatility and illiquid capital markets.

By effectively pre-paying nearly two years of obligations, Strategy Inc. has achieved several critical goals:

- De-Risking Preferred Stock: The reserve elevates the short-term liquidity profile of its high-yield preferred stocks, making them highly attractive to fixed-income investors.

- Validation of Digital Credit: It proves that the "Digital Credit" model can attract and hold traditional capital buffers, serving as a successful transformer that absorbs Bitcoin volatility and outputs stable USD cash flows.

- Insulating the Treasury: It eliminates the existential pressure to liquidate any portion of the 650,000 BTC treasury stack to meet short-term financial requirements, thus maintaining the integrity of the long-term accumulation mandate.

The reserve fundamentally transforms Strategy Inc. into a hybrid entity. It combines the aggressive, future-focused nature of a massive digital asset treasury with the conservative, risk-buffered discipline of traditional finance. This hybrid posture may feel more acceptable to institutional investors, regulators, and debt holders than a purely crypto-centric model.

The 21 months is more than just a duration; it is an invaluable strategic commodity. It provides Strategy Inc. with optionality and time: the time needed for the company’s long-term thesis—that Bitcoin will appreciate and potentially demonetize traditional assets—to play out without the threat of near-term solvency issues. The success of this model now depends entirely on execution: maintaining the reserve, optimizing the capital structure, and successfully navigating the long-term risk posed by the 731 million USD annual fixed obligation. The 1.44 billion USD cash reserve is the ultimate proof that Strategy Inc. has engineered a sophisticated financial mechanism to bridge the chasm between the fiat economy and the digital asset economy, buying time for the revolution it seeks to lead.