The Battle for the Balance Sheet: Strategy Inc. vs. MSCI and the Future of Digital Asset Treasuries

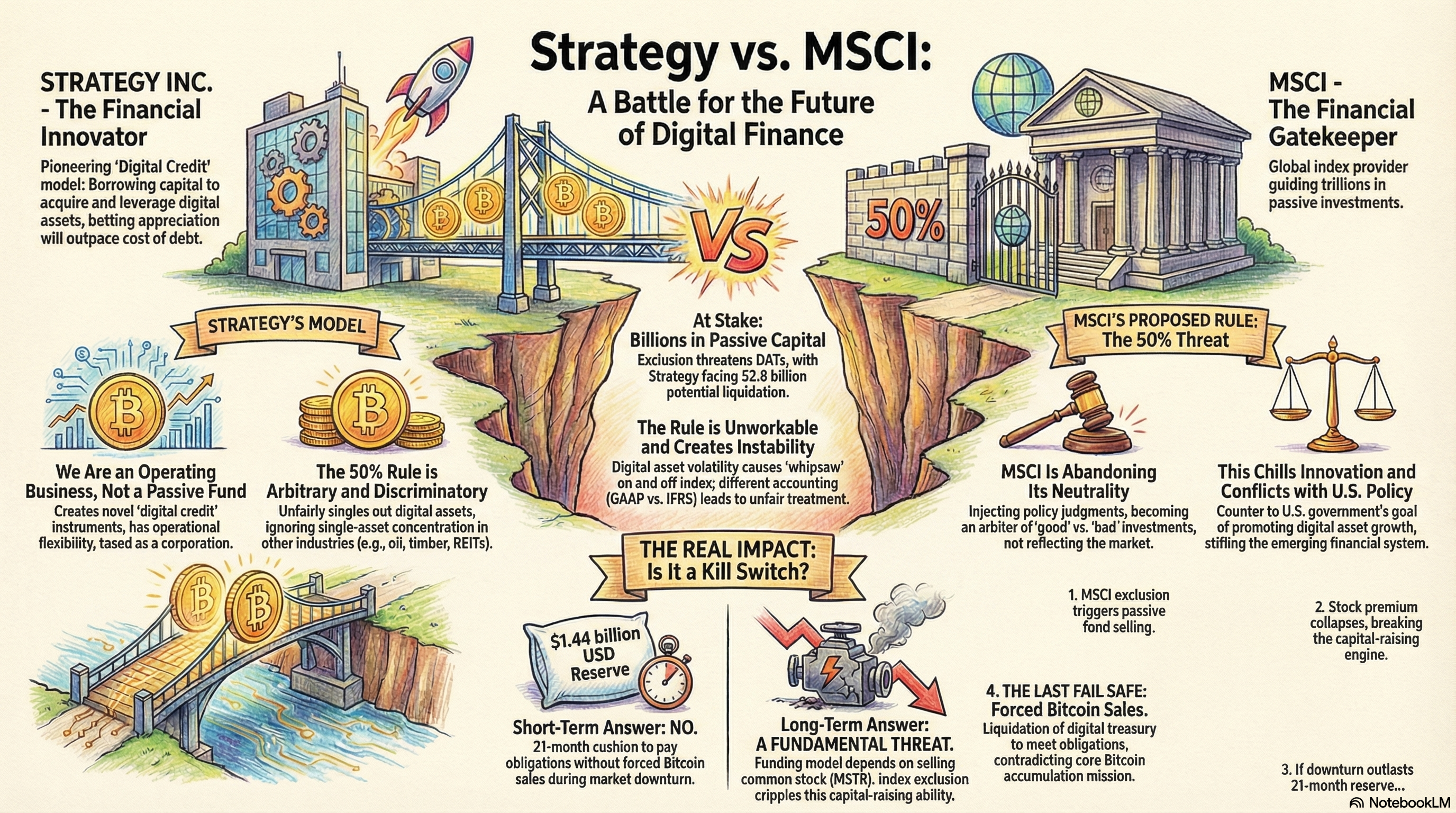

The confrontation between Strategy Inc., the self-proclaimed "world's first and largest Bitcoin treasury company", and MSCI, the venerable global financial index provider, represents a pivotal clash between radical financial innovation and the established mechanisms of the old guard financial gatekeepers. At its heart, the battle is over classification: whether the aggressive, leveraged holding of digital assets constitutes an "operating business" or a "passive investment fund". The outcome will not only determine the flow of billions of dollars but will also shape the future legitimacy and funding models of all Digital Asset Treasury companies (DATs).

The Challenger’s Innovation: Digital Credit

Strategy Inc. operates as a "financial transformer", systematically borrowing fiat capital from traditional markets via structured securities—a process Strategy terms "Digital Credit". The entire model is built on an institutional-scale arbitrage bet: borrowing money at a known cost and hoarding Bitcoin, betting that Bitcoin's long-term appreciation will massively outpace the cost of servicing that fiat capital.

To fund this treasury, Strategy has created a complex "menu of risk," including common stock (MSTR) which acts as a leveraged call option on Bitcoin, and preferred stock (STRC, STRF, STRK). This sophisticated architecture is designed to monetize the volatility of its equity (MSTR) to secure the stability of its debt (STRC, STRF). This continuous, external capital raising is the primary revenue driver for its fixed obligations.

The Gatekeeper’s Threat and Strategy’s Rebuttal

The conflict was triggered by MSCI’s proposal to exclude all companies whose digital asset holdings represent 50% or more of total assets from its Global Investable Market Indexes. Strategy Inc. responded with a detailed open letter, challenging the arbitrary nature of the exclusion point-by-point:

-

DATs Are Operating Businesses, Not Investment Funds MSCI's proposal rests on the fundamental mischaracterization of DATs as investment funds. Strategy argues it does not passively hold Bitcoin but actively uses it to create returns for shareholders. Strategy's core value proposition lies in designing and offering unique digital credit instruments—such as preferred stocks with fixed and variable dividend rates and varying seniorities—a business model comparable to banks or insurance companies. Unlike an investment fund, Strategy retains operational flexibility to adapt its value-creation strategies and is governed as a conventional operating company, subject to corporate-level taxation.

-

The 50% Threshold is Discriminatory, Arbitrary, and Unworkable Strategy condemned the digital-asset-specific 50% rule as unfairly singling out Bitcoin concentration while leaving other industries, such as oil, timber, and REITs, untouched despite similarly concentrated single-asset holdings. Furthermore, the proposal is unworkable because the historical volatility of digital assets would cause DATs to constantly "whipsaw on and off" MSCI’s indices, creating index instability. Strategy also noted that different international accounting principles (e.g., IFRS versus GAAP) would lead to disparate treatment based on geography or asset type.

-

The Proposal Improperly Injects Policy Judgments Strategy accused MSCI of compromising its perceived neutrality as a standard-setting organization. MSCI holds itself out as a neutral provider reflecting "the evolution of the underlying equity markets" and not passing judgment on whether any market or company is "good or bad". By discriminating against one asset type, Strategy argues the proposal transforms MSCI into an arbiter of investment decisions, undermining the reliability of its indices.

-

The Proposal Conflicts with Federal Strategy and Chills Innovation Strategy emphasized that the proposal runs counter to the U.S. government's goal of promoting the growth and adoption of digital assets as a cornerstone of economic development. Strategy estimated that exclusion could result in up to 2.8 billion USD of its stock being liquidated, thereby shutting DATs out of the passive-investment universe and drastically weakening their competitive position. This would stifle innovation in the emerging financial system that DATs are actively building.

-

If Still Inclined to Treat DATs Differently, MSCI Should Extend Consultation Finally, Strategy urged MSCI to reject the "rushed and reactionary exclusion" and adopt a deliberative approach, allowing the market and the technology to mature before making such consequential classification changes.

Conclusive Argument: Does Exclusion Effect STRC Holders as a Kill Switch?

The exclusion of Strategy’s common stock (MSTR) from major indices like MSCI is not an immediate kill switch for STRC preferred shareholders, but it presents a significant long-term vulnerability to the funding model.

Why it is not an immediate kill switch: STRC, the "Stretch" preferred stock, is engineered for principal stability and high yield. Its security is guaranteed in the medium term by the 1.44 billion USD Reserve. This cash fortress provides a guaranteed 21-month cushion for all preferred dividends and debt interest obligations, regardless of short-term Bitcoin price volatility. This reserve allows the company to avoid forced Bitcoin sales to service obligations during a market downturn. Furthermore, STRC benefits from its structural seniority in the liquidation waterfall, confirmed to protect principal even in a catastrophic 82.8% Bitcoin drawdown.

Why it represents a fundamental threat to the long-term funding model: The exclusion of MSTR, leading to an estimated billion-dollar outflow, would severely impair Strategy’s ability to execute its funding model. The entire "Digital Credit" structure is dependent on the ATM arbitrage: selling MSTR common stock at a premium valuation to raise cash for the USD Reserve. If MSTR is delisted or the premium collapses due to passive index selling, the engine that replenishes the cash reserve breaks down.

If a sustained market downturn lasts longer than the 21-month reserve and the company’s ability to raise new equity is compromised, corporate risk disclosures confirm the "last fail safe" comes into play: the forced sale of Bitcoin to satisfy financial obligations, which include the cumulative preferred dividends owed to STRC holders. While the cumulative feature ensures STRC holders will eventually be paid, the process would realize massive capital losses, directly contradicting the company's core accumulation philosophy.

In summary, the MSCI exclusion is not an explosive trigger, but it is an acid test of the financial fortress. The cash reserve guarantees solvency for the next two years, buying Strategy time to find an alternative funding mechanism. However, if Strategy cannot restore its access to capital markets, the preferred stock, despite its structural seniority, would eventually rely on the very mechanism the company was founded to avoid: liquidating its digital treasury.

Support Strategy Inc.'s Stance

Strategy Inc. believes that broad community engagement is crucial to preserving innovation in the digital asset space. You can learn more about their position and show your support by visiting their dedicated page: Strategy Inc. MSCI Response.

Consider supporting Strategy Inc.'s efforts by:

- Emailing MSCI directly with your feedback.

- Registering your support on relevant financial advocacy platforms.

- Sharing this information on social media to raise awareness.