Gatekeepers of Your 401(k) v/s Bitcoin Braves: The Battle for the Core Menu

Date: December 11, 2025

Subject: The Legislative and Regulatory Conflict Over Digital Assets in Defined Contribution Plans

Date: December 11, 2025

Subject: The Legislative and Regulatory Conflict Over Digital Assets in Defined Contribution Plans

Abstract

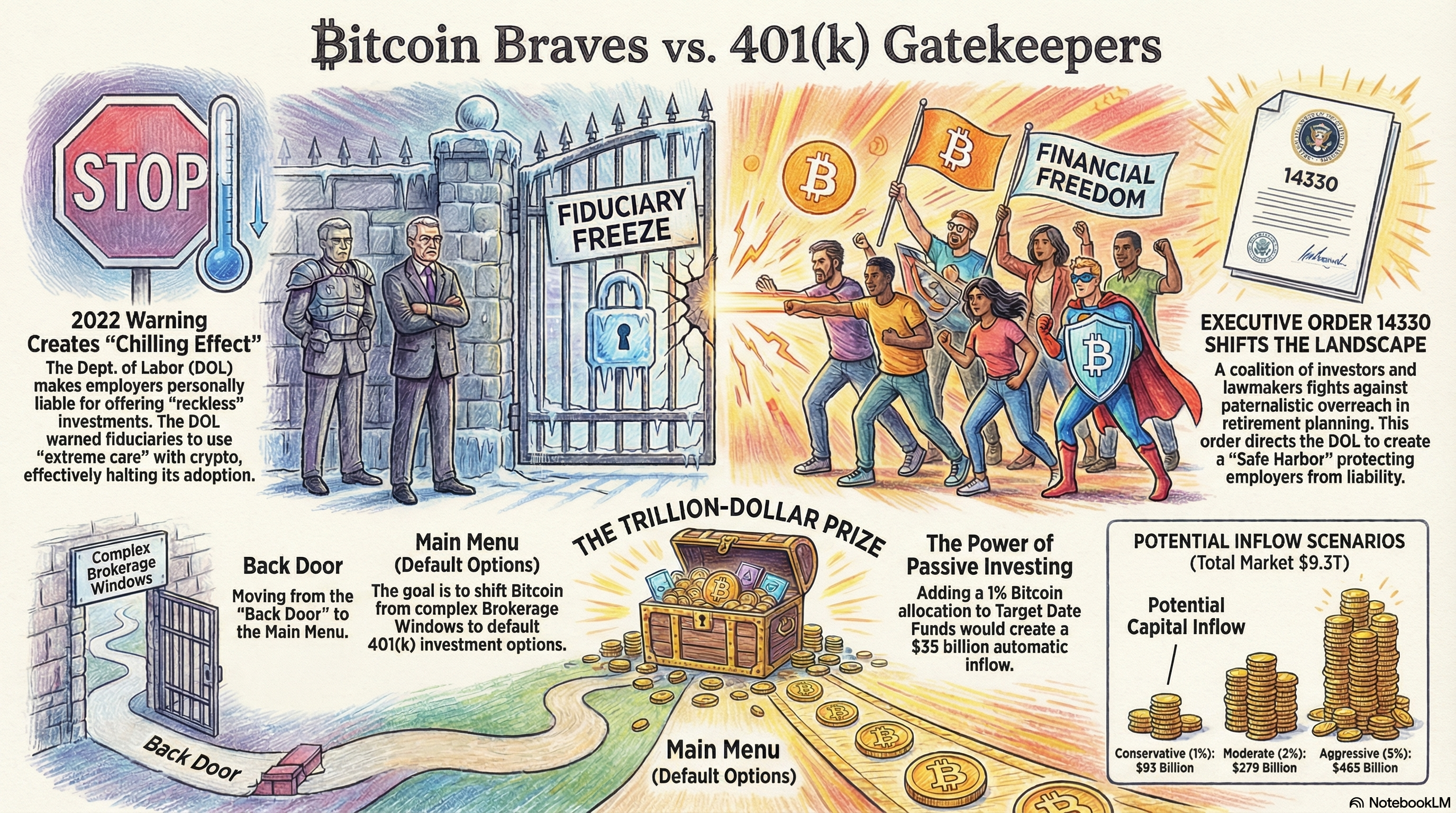

As of late 2025, the U.S. retirement market holds approximately USD 9.3 trillion in 401(k) assets. Yet, despite the widespread adoption of Bitcoin ETFs in personal brokerage accounts, nearly 0% of this capital is allocated to digital assets within standard "Core Menus." This paper examines the conflict between the "Gatekeepers"—federal regulators and risk-averse plan fiduciaries—and the "Bitcoin Braves"—a coalition of retail investors and congressional leaders pushing for access. It analyzes the pivotal impact of Executive Order 14330 and the Retirement Investment Choice Act in dismantling the "fiduciary freeze" that has historically blocked Bitcoin from the world’s largest capital pool.

I. The Gatekeepers: The Fiduciary Freeze

For decades, the primary gatekeepers of the American 401(k) have been the Department of Labor (DOL) and the Employee Benefits Security Administration (EBSA). Their mandate is to enforce the Employee Retirement Income Security Act of 1974 (ERISA), specifically the "prudent man rule," which holds employers personally liable if they offer reckless investment options to employees.

The "Chilling Effect" of 2022

The conflict stems largely from Compliance Assistance Release No. 2022-01, issued by the DOL in March 2022. This guidance warned plan fiduciaries to exercise "extreme care" before adding cryptocurrencies to 401(k) investment menus, explicitly threatening investigation programs for plans that did so [1].

- The Result: While not an explicit ban, this created a "regulatory freeze." Fiduciaries (employers) operate on a basis of liability minimization. Even after the approval of Bitcoin ETFs in 2024 made the asset class regulated and securitized, the fear of DOL litigation kept Bitcoin off the "Core Menu" of major recordkeepers like Vanguard and Fidelity.

II. The Bitcoin Braves: The Push for "Financial Freedom"

Opposing the gatekeepers is a growing coalition of "Bitcoin Braves"—comprising retail investors utilizing Self-Directed Brokerage Accounts (SDBAs) and a coordinated bloc of legislative allies who view 401(k) restrictions as paternalistic overreach.

The Legislative Offensive (2025)

Following the changing political winds of the 2024 election, this group launched a targeted offensive to unblock retirement capital.

- The Hill-Atkins Letter (September 2025): On September 22, 2025, House Financial Services Committee Chairman French Hill (R-AR) led a coalition letter to SEC Chair Paul Atkins. The letter argued that the SEC’s "accredited investor" definition was effectively segregating the working class from high-yield alternative assets, leaving them with underperforming bond funds while wealthy investors accessed crypto and private equity [2].

- The "Retirement Investment Choice Act" (H.R. 5748): Introduced in October 2025 by Rep. Troy Downing (R-MT), this bill seeks to strip the DOL of its ability to restrict asset classes based on "merit," effectively codifying that fiduciaries cannot be sued solely for the volatility of an asset, provided the structure (ETF) is regulated [3].

III. The Tipping Point: Executive Order 14330

The conflict reached its climax on August 7, 2025, when President Trump signed Executive Order 14330, titled "Democratizing Access to Alternative Assets for 401(k) Investors" [4].

The Mandate for a "Safe Harbor"

The EO fundamentally alters the liability landscape for employers. It directs the DOL to:

- Rescind the 2022 Warning: This was formally executed in May 2025, signaling a return to "neutrality."

- Establish a Safe Harbor (Due Feb 2026): The order grants the DOL 180 days to draft rules that protect employers from litigation if they offer regulated "alternative assets" (specifically defining digital assets) as part of a diversified portfolio.

The "Menu" vs. "Window" Paradigm

The ultimate goal of EO 14330 is to move Bitcoin from the "Window" (the friction-heavy SDBA options used by less than 3% of employees) to the "Menu" (the default list of funds).

- The Passive Flow Thesis: If Bitcoin ETFs are included in Target Date Funds (TDFs)—even at a conservative 1% allocation—the resulting capital inflow would be automatic and recurring. With USD 3.5 trillion currently sitting in TDFs, a 1% shift represents a USD 35 billion mandatory bid for Bitcoin, unrelated to daily market sentiment.

How the Self-Directed Brokerage Window (SDBW) Works

The Self-Directed Brokerage Window (SDBW) is essentially a "back door" or "secret menu" built into many standard 401(k) plans. It allows you to bypass the limited list of 10–20 funds your employer selected (the "Core Menu") and access the wider stock market—including Bitcoin ETFs—using your 401(k) money.

Here is how it works and how to check if you have one.

1. The Concept: "The Plan within a Plan"

Imagine your 401(k) is a cafeteria.

- The Core Menu: The cafeteria only serves pizza, salad, and burgers (Target Date Funds, S&P 500).

- The Brokerage Window: There is a side door in the cafeteria that leads to a full supermarket. You can take your lunch money, walk through the door, and buy whatever you want (Bitcoin ETFs, Apple stock, Gold, etc.).

2. How to Use It (Step-by-Step)

If your plan offers this, the process is usually similar across major providers (Fidelity, Schwab, Empower, Vanguard).

Step 1: Locate the Option Log in to your 401(k) website. Look for terms like:

- Fidelity: "BrokerageLink"

- Schwab: "Personal Choice Retirement Account (PCRA)"

- Empower/Vanguard: "Self-Directed Brokerage" or "Brokerage Option"

Step 2: Open the Sub-Account You usually have to click a button to "enroll" in the brokerage window. This creates a separate sub-account linked to your main 401(k).

- Note: This often requires reading a disclaimer acknowledging that your employer is not responsible if you lose money here.

Step 3: "Fund" the Window You cannot buy the Bitcoin ETF directly from your paycheck. Instead, you must:

- Contribute to the Core Menu as usual (e.g., into a Money Market or S&P 500 fund).

- Manually transfer cash from the Core account into the Brokerage Window account.

Step 4: Buy the Ticker Once the cash settles in the Brokerage Window, you can trade just like a normal investment account. You would search for the tickers (e.g., IBIT for BlackRock's Bitcoin ETF, FBTC for Fidelity's, or MSTR) and click buy.

3. The "Catch" (Restrictions & Fees)

Employers often put guardrails on these windows to stop you from going "all in."

- The 50% Rule: Many plans only allow you to move 50% of your total portfolio into the brokerage window. They want to ensure at least half your money stays in "safe" core funds.

- Trading Fees: While many ETFs are commission-free now, some SDBAs charge an annual maintenance fee (e.g., USD 50/year) or per-trade fees, unlike the free core funds.

- The "Nanny" Filter: Occasionally, an employer will specifically block certain asset classes (like "Crypto") even in the window. However, since Bitcoin ETFs are technically "Equities/ETFs," they often slip through filters that block actual coins.

Why this is the solution for Bitcoin

Until Congress or the SEC explicitly creates the "Safe Harbor" we discussed earlier, your employer will likely not add Bitcoin to the main menu. They are happy, however, to let you take the risk by using the Brokerage Window.

The Math of the Trillions

As of mid-2025, there is approximately USD 9.3 trillion held specifically in 401(k) plans (part of a broader USD 45.8 trillion US retirement market).

Currently, because of the "friction" you described (extra paperwork, fees, and fear), the amount of that money allocated to Bitcoin is effectively negligible (near 0%).

If that friction is removed and Bitcoin ETFs become a standard "Core Menu" option, here is the math on the potential capital inflow to Bitcoin:

1. The Potential Inflow (The Math)

Analysts generally model this based on standard portfolio diversification recommendations (typically 1% to 5% for "alternative assets").

| Scenario | Allocation % | Capital Inflow to Bitcoin | Impact |

|---|---|---|---|

| Conservative | 1% | USD 93 Billion | Equivalent to buying ~90% of all Bitcoin on exchanges* |

| Moderate | 3% | USD 279 Billion | Would likely multiplier-effect the price significantly |

| Aggressive | 5% | USD 465 Billion | Exceeds the current market cap of Ethereum |

*Note: "Bitcoin on exchanges" refers to liquid supply available for purchase, which is estimated to be roughly 2 million BTC (approx USD 180B–USD 200B at late 2025 prices). A USD 93B inflow is massive relative to liquid supply.

2. Why "Removing Friction" Changes the Game

You mentioned that you can already buy Bitcoin via the self-directed window. That requires active intent. The reason Congress pushing for "Core Menu" inclusion is so powerful is because of passive flows.

- The "Default" Effect: Most 401(k) money sits in Target Date Funds (TDFs). These are the "set it and forget it" funds that adjust based on your age.

- The TDF Unlock: TDFs currently hold about USD 3.5 trillion of that 401(k) money.

- The Scenario: If the friction is removed, BlackRock or Fidelity could add a 1% Bitcoin allocation inside their Target Date 2055 Fund.

- The Result: Tens of millions of Americans would instantly start buying Bitcoin every two weeks with their paycheck, without ever clicking a button or even knowing they own it.

3. Summary

The "unnecessary friction" of the self-directed window acts as a dam.

- With Friction (Now): Only die-hard believers (like you) climb over the dam to buy.

- Without Friction (Core Menu): The dam breaks, and even "passive" money flows into the asset class automatically via diversified funds.

IV. Conclusion: The Dam Breaks in 2026

The battle between Gatekeepers and Braves is effectively a battle over default options. The "Gatekeepers" successfully used friction and fear to keep Bitcoin out of the default 401(k) infrastructure for five years. However, with the rescission of the DOL's 2022 guidance and the impending "Safe Harbor" rules from Executive Order 14330, the legal dam is cracking.

If the "Retirement Investment Choice Act" passes, or if the February 2026 DOL guidance provides sufficient liability protection, the friction will vanish. The result will likely be the institutionalization of Bitcoin not just as a speculative trade, but as a standard component of the American retirement portfolio.

References

- U.S. Department of Labor. (2022). Compliance Assistance Release No. 2022-01: 401(k) Plan Investments in "Cryptocurrencies". Employee Benefits Security Administration.

- Committee on Financial Services. (2025, September 22). Letter from Chairman French Hill to SEC Chairman Paul Atkins regarding Accredited Investor Definitions and Retirement Access.

- U.S. House of Representatives. (2025). H.R. 5748 - Retirement Investment Choice Act. 119th Congress. Sponsor: Rep. Troy Downing.

- The White House. (2025, August 7). Executive Order 14330: Democratizing Access to Alternative Assets for 401(k) Investors. Federal Register Vol. 90.