The Pivot from eCash to Digital Credit: Bitcoin’s Evolution and the Rise of the Corporate Treasury Yield Curve

Summary: The "Killer App" Has Arrived

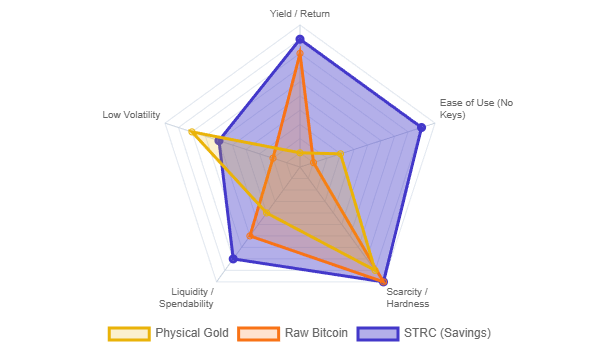

For fifteen years, critics and proponents alike searched for Bitcoin’s "killer app." The initial search focused on payments—a decentralized version of Visa to facilitate daily coffee purchases. When that stalled due to scaling friction and volatility, the narrative shifted to gold replacement—a sovereign store of value. While successful for institutions, this use case remained elusive for the average person due to the terrifying complexity of self-custody. As we enter 2026, a third and definitive era has emerged. Bitcoin has found its true killer app: The Global Savings Account. This report argues that the barrier to mass adoption was never volatility, but usability. Just as the internet (TCP/IP) remained a niche tool until Email made it indispensable, and cellular networks were clunky until the iPhone packaged them for the masses, Bitcoin required an application layer to strip away the complexity of private keys. That application is Digital Credit. Strategy Inc. (formerly MicroStrategy) has pioneered this layer with STRC (Series A Perpetual Stretch Preferred Stock). By offering a tax-advantaged yield that was raised to 11.00% in January 2026, STRC transforms Bitcoin from a volatile asset into a productive savings vehicle accessible via any brokerage account. This shift unlocks a Total Addressable Market (TAM) of USD 11 Trillion in US corporate bonds alone—as evidenced by the chart of the booming bond market—positioning Bitcoin not as a currency for spending, but as the collateral backing a high-yield savings account for 8 billion people.

1. The "iPhone Moment": Solving the Custody Crisis

1.1 The Failure of the "User" Interface

The history of technology shows that mass adoption only occurs when complexity is abstracted away from the end user.

- The Internet: Early users had to navigate command lines. Adoption exploded only when browsers and email clients hid the underlying TCP/IP protocols.

- Mobile: Early smartphones were cumbersome. The iPhone succeeded because it replaced styluses and file systems with a touch interface. Bitcoin’s "interface" has historically been its biggest failure. The ethos of "Not Your Keys, Not Your Coins" demands a level of personal security hygiene that is incompatible with human psychology. Studies show that 70% of people feel overwhelmed by simple password management, and 53% reuse passwords despite security risks.1 Expecting the global population to manage irreversible private keys for their life savings was a design bottleneck that capped adoption at "technologists" and "ideologues."

1.2 STRC as the Interface Layer

The introduction of "Digital Credit" products like STRC represents Bitcoin’s "iPhone moment."

- Abstraction of Risk: Investors buy a ticker symbol (STRC) in a standard brokerage account. There are no seed phrases to lose, no hardware wallets to update, and no "fat finger" errors that burn funds.

- Regulatory Rails: The assets are protected by SIPC insurance (against broker failure) and operate within the familiar framework of NASDAQ and the SEC.

- Utility: Unlike raw Bitcoin, which sits idle in a wallet, STRC generates monthly cash flow. By financializing Bitcoin into a preferred stock, Strategy Inc. has created a user experience that allows a grandmother in Ohio or a pension fund in Japan to utilize the Bitcoin network without ever interacting with the blockchain.

2. A Reality Check: Why eCash Failed (And Why It Doesn't Matter)

To understand the magnitude of the "Savings Account" breakthrough, one must acknowledge why the previous "Payments" narrative failed.

2.1 The Stagnation of Payments

The dream of paying for coffee in Satoshis (SATs) has largely evaporated.

- Base Layer: Bitcoin’s base layer settles approximately USD 7.8 billion in "economic" volume daily, a fraction of Visa’s USD 39.7 billion.3

- Lightning Network: Despite years of development, the Lightning Network’s capacity hovers around USD 509 million (approx. 5,358 BTC).4 It has not achieved the viral, exponential growth of a consumer payment app like Venmo or WeChat Pay.

- Stablecoin Victory: The market has chosen stablecoins (USDT, USDC) for payments. Stablecoins settled over USD 18 trillion in 2024, proving that users want blockchain speed with fiat stability.5

2.2 The Pivot to Collateral

This failure as a payment rail was a necessary evolution. By failing to become high-velocity cash, Bitcoin succeeded in becoming pristine collateral. Its deflationary nature makes it terrible for spending (Gresham's Law) but perfect for backing liabilities. This realization birthed the "Digital Credit" market: using Bitcoin’s capital appreciation to fund high-yield savings products for the masses.

3. The Target: An USD 11 Trillion Ocean of Capital

The "Killer App" thesis is validated by the sheer size of the market it aims to disrupt. It isn't the USD 5 coffee market; it is the multi-trillion USD savings market.

3.1 Visualizing the Prize: The US Corporate Bond Market

Recent market data visualizes the scale of this opportunity. The US Corporate Bond Market (Investment Grade + High Yield) reached an all-time high of USD 11 Trillion in 2025.

- The Chart: As shown in recent market analysis, the mountain of corporate debt has grown exponentially from roughly USD 1 trillion in 1990 to over USD 11 trillion today.

- The Implication: This USD 11 trillion represents capital that is already seeking yield. It is parked in corporate promises, often earning 4-6% yields that are fully taxable.

- The Disruption: Strategy Inc. is attacking this specific market. By offering an 11% yield (tax-advantaged), they are providing a superior product to the "High Yield" (junk bond) sector that makes up a significant portion of that USD 11 trillion pile. Capturing even 1% of this market would inject USD 110 billion of buying pressure into Bitcoin.6

3.2 The STRC Value Proposition (Updated Jan 2026)

STRC is the flagship product targeting this market. It offers a value proposition that traditional bonds cannot match:

- Yield: As of January 1, 2026, Strategy Inc. increased the annualized dividend rate to 11.00%.

- Frequency: Dividends are paid monthly, matching the liability cycle of households (rent, bills).

- Tax Efficiency: Distributions are structured as "Return of Capital" (ROC), meaning they are largely tax-deferred until the stock is sold.7

- Comparison: A 6% corporate bond yield is fully taxed as ordinary income. For a high earner, an 11% tax-deferred yield is equivalent to a ~18-20% taxable yield. This is the "killer app": A savings account that pays double-digit yields, defers taxes, and requires zero technical knowledge to use.

4. The Engine: How Strategy Inc. Generates the Yield

How can a savings account pay 11% when banks pay 4%? The answer lies in Strategy Inc.'s "Bitcoin Yield" engine (formerly BTC per Share Accretion).

4.1 The Volatility Arbitrage

Strategy Inc. (MSTR) trades at a premium to its Net Asset Value (NAV) because investors are willing to pay for the convenience, leverage, and yield it provides.

- Accretive Issuance: When MSTR trades at a premium (e.g., 2.0x NAV), the company issues new shares. It uses the proceeds to buy more Bitcoin.

- The Math: If MSTR issues USD 200 of stock to buy USD 200 of Bitcoin, but the shares were only backed by USD 100 of Bitcoin previously, the amount of Bitcoin per share increases for everyone.

- Funding the Yield: This accretive value creation allows the company to service the 11% dividend on STRC without depleting its capital base, assuming the premium persists and Bitcoin appreciates over the long term.8

4.2 The "War Chest": A 3-Year Cash Cushion (Updated)

Critics often argue that a "crypto winter" could force Strategy Inc. to sell Bitcoin to pay dividends. The company has aggressively moved to eliminate this risk.

- The Filing: According to the Form 8-K filed on December 22, 2025, Strategy Inc. increased its USD Reserve to USD 2.19 billion.9

- The Impact: This massive cash pile provides approximately 3 years of dividend coverage at current payout levels.

- The Significance: This "War Chest" effectively decouples the yield reliability from the asset volatility. Even if Bitcoin enters a prolonged bear market, Strategy Inc. can continue paying the 11% yield on STRC until nearly 2029 without selling a single Satoshi. This turns a volatile asset into a stable income generator for the saver.

5. Conclusion: The Cusp of Gargantuan Change

We are witnessing the maturity of the Bitcoin network. The teenage years of "magic internet money" and failed coffee payments are over. Bitcoin has entered its adult phase as Digital Capital. Strategy Inc. has successfully built the bridge—the "email client" for the Bitcoin protocol. By packaging Bitcoin collateral into STRC, they have created a product that allows any saver, anywhere in the world with brokerage access, to opt out of the fiat savings system and into a Bitcoin-backed yield curve.

- Did Bitcoin find its killer app? Yes. It is Digital Credit.

- Is it a Gold replacement? No, it is better. Gold sits in a vault and costs money to store. Digital Capital works to generate an 11% yield.

- Are we at the cusp of gargantuan change? With an USD 11 trillion US bond market and a USD 290 trillion global savings market looking for a life raft against inflation, the migration of wealth into Digital Credit has likely only just begun. For the saver, the message is simple and hopeful: You no longer need to be a cryptographer to save in Bitcoin. You just need to buy the stock that acts like a savings account.

Web links

- The Psychology of Security: Why Users Resist Better Authentication - Deepak Gupta

- Password psychology: Why professionals still make terrible passwords - Silicon

- Bitcoin & Stablecoins: Challenging Visa & Mastercard in Global Payments? - Markets.com

- The Lightning Network: - Fidelity Digital Assets

- Charted: Stablecoins Are Now Bigger Than Visa or Mastercard - Visual Capitalist

- Saving and Checking Account - Retail banking market outlook

- Return of Capital Information - Strategy

- Strategy Announces Third Quarter 2025 Financial Results

- 8-K - SEC.gov