Story of "store of value" - from Gold to Code

Chapter 1: The Metaphysics of Value and the Primordial Inventor

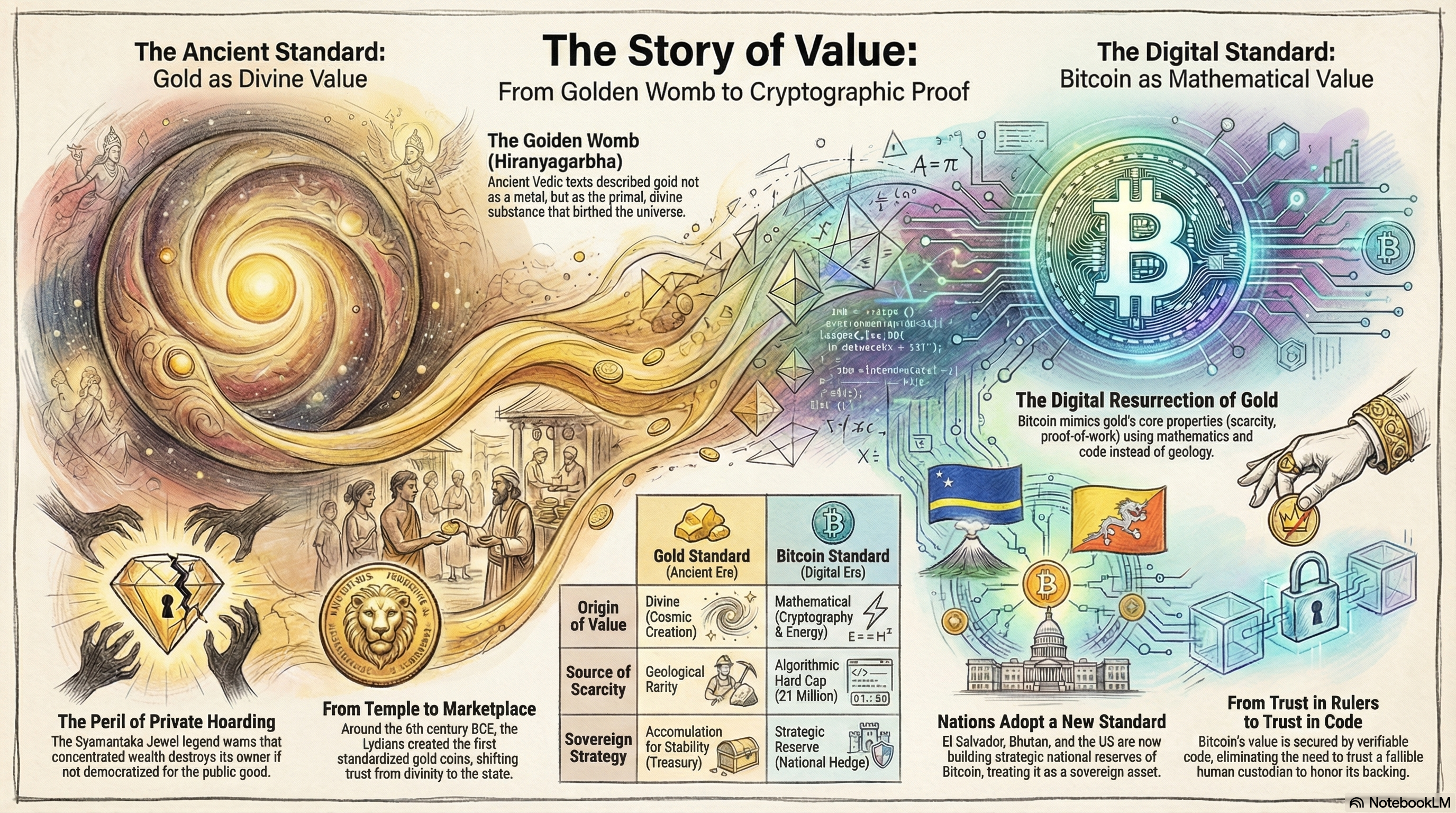

To comprehend the history of gold is to journey back to the very inception of the cosmos, where metallurgy dissolves into mythology and economics merges with theology. The question of "who invented gold" is, in the ancient consciousness, synonymous with the question of "who invented the universe." Unlike the modern materialist view, which categorizes gold as Element 79—a transition metal formed by stellar nucleosynthesis—the ancient seers perceived it as the solidified residue of divine creation, a substance imbued with the distinct characteristics of immortality and solar radiance.

1.1 The Concept of Hiranyagarbha: The Golden Womb

In the vast and intricate tapestry of Vedic philosophy, the origin of gold is not geological but cosmological. The term Hiranyagarbha serves as the foundational concept for this narrative. Composed of two Sanskrit roots—hiraṇya (gold) and garbha (womb, egg, or embryo)—it poetically translates to the "Golden Womb" or "Universal Germ". This concept finds its most profound expression in the Rigveda (RV 10.121), specifically in the Hiraṇyagarbha Sūkta, which posits a single creator deity who emerged from this golden matrix to manifest the universe.

The Rigveda opens this cosmological account with the declaration: Hiraṇyagarbhaḥ samavartatāgre bhūtasya jātaḥ patirekāsīta—"In the beginning, there was the Golden Womb; the One Lord of all that exists was born". This verse establishes gold not merely as a precious metal but as the primal substance of existence. Before the earth, the sky, or the gods themselves existed, there was the Golden Womb, floating in the primordial waters of non-existence.

1.1.1 The Mechanics of Creation in Puranic Texts

The Matsya Purāṇa (2.25–30) provides a more granular account of this creative process, offering what could be considered the "invention story" of gold. The narrative begins with Mahāprālaya, the great dissolution, where the universe was reduced to a state of darkness and sleep. From this void arose Svayambhu, the Self-Manifested Being, a form beyond sensory perception.

Svayambhu, desiring to create, first brought forth the primordial waters (Apah). Into these waters, he cast a seed. This was not a biological seed, but a metaphysical singularity containing the potentiality of all matter and energy. Upon contact with the waters, the seed transmuted into a golden egg (Hiranyagarbha), described as possessing the brilliance of a thousand suns.

It is here that the "invention" occurs. Gold was not discovered by humans; it was manufactured by the Creator as the vessel for life. Brahma, the progenitor of the worlds, was born within this golden egg. After dwelling therein for a year (a cosmic cycle), Brahma divided the egg into two halves by the power of his thought. The upper shell became Svarga (Heaven) and the lower shell became Pṛthvi (Earth), while the space between formed the sky. Thus, every vein of gold found within the earth is, in mythological terms, a fragment of that original cosmic shell—a shard of the divine womb that birthed reality.

1.1.2 Philosophical Implications of the Golden Origin

The identification of the Creator with gold has profound theological implications that ripple into economic history. The Rigveda asks the refrain, kasmai devāyahaviṣā vidhema—"To which God shall we offer our oblation?". The answer, invariably, points back to the source: the One who emerged from the gold.

This association imbues gold with the property of Tejas (radiance) and Amrita (immortality). Unlike iron or copper, which corrode and decay, gold remains immutable, mirroring the nature of the Brahman (the Ultimate Reality) which is unchanging amidst the transient world. In Vedic rituals, gold is often treated as a representation of Agni (Fire) and Surya (Sun) buried within the earth. To possess gold was not merely to hold wealth; it was to hold a piece of the sun, a fragment of the immortal sphere in the mortal coil.

The Manu Smṛti (1.9) reinforces this by stating that the seed became a golden egg equal in brilliance to the sun. This solar connection is critical. In ancient thought, gold is "solidified sunlight." This explains its universal appeal across civilizations not in contact with one another; the sun is the universal giver of life, and gold is its earthly avatar. Therefore, the "inventor" of gold is the cosmos itself, acting through the divine will of Nārāyaṇa or Prajapati.

1.3 Comparative Mythologies: The Universal Standard

While the Vedic tradition offers the most elaborate metaphysics of gold, other ancient civilizations shared this reverence, effectively "pegging" their cultural values to the metal long before they pegged their currencies.

1.3.1 The Egyptian Flesh of the Gods

The Ancient Egyptians, much like the Vedic seers, associated gold with the divine and the eternal. They believed that gold was the "flesh of the gods," specifically the Sun God Ra. This theological belief drove their obsession with accumulation—not for economic trade, but for the afterlife. The funeral mask of King Tutankhamun is not a display of fiscal wealth but a theological instrument, transforming the deceased pharaoh into an imperishable, solar being. The Egyptians were among the first to smelt and alloy gold, yet they did not use it as a barter currency initially; its value was transcendent, reserved for the divine and the royal.

1.3.2 The Lydian Innovation

If the gods invented gold as a substance, the Lydians invented it as money. Around the 6th century BCE, in the Kingdom of Lydia (modern-day Turkey), King Croesus is credited with a pivotal innovation: the standardization of gold coinage. Prior to this, gold circulation was hindered by the need to weigh and test purity for every transaction. The Lydians began minting coins from electrum (a natural alloy of gold and silver) and later pure gold, stamping them with the royal seal.

This transition marks the shift from Hiranyagarbha (cosmic value) to Arthashastra (economic value). The stamp on the coin replaced the divine aura; trust was now placed in the state rather than the gods. This was the moment gold moved from the temple to the marketplace, setting the stage for the monetary systems that would dominate the next two and a half millennia.

Chapter 2: The Political Economy of Dwarka — Lord Krishna’s Democratization of Gold

While the Vedic hymns elucidate the origin of gold, the Puranic texts—specifically the story of the Syamantaka Jewel—offer a sophisticated discourse on the governance of gold. This narrative, found in the Bhagavata Purana and Vishnu Purana, presents Lord Krishna not just as a deity, but as a visionary statesman grappling with the dangers of centralized wealth and the necessity of public stewardship.

2.1 The Legend of the Syamantaka Jewel

The story unfolds in the city-state of Dwarka, the maritime fortress governed by the Yadu dynasty. A nobleman named Satrajit, a fervent devotee of Surya (the Sun God), was blessed with a divine gift: the Syamantaka Mani (Jewel).

This jewel was the ultimate engine of wealth creation. The texts specify its output with economic precision: it produced eight bharas of gold every single day. To contextualize this in modern terms, ancient Indian measurements define a bhara based on the weight of gunja seeds and palas. One bhara is approximately 20 tulas. Calculations based on these metrics suggest that eight bharas equate to roughly 170 pounds (approximately 77 kilograms) of gold daily.

At current market rates (assuming roughly USD 80,000 per kg in a speculative modern equivalent), this jewel generated over USD 6 million of liquidity per day. For a city-state like Dwarka, this was a destabilizing influx of capital. It represented a "Cantillon Effect" of the highest order, where the injection of new money was concentrated entirely in the hands of one private individual, Satrajit, rather than the state treasury.

When Satrajit wore the jewel, he shone with such brilliance that the citizens mistook him for the Sun God himself. This detail is crucial: extreme wealth creates a mirage of divinity. It grants the holder a power that rivals the sovereign, threatening the social contract.

2.2 The Proposal for Democratization

Lord Krishna, observing this dynamic, recognized the threat posed by the Syamantaka Jewel. It was not merely a pretty stone; it was a sovereign-grade asset capable of altering the balance of power in the region. Krishna approached Satrajit with a radical proposal: Donate the Syamantaka jewel to King Ugrasena, the ruler of the Yadus.

2.2.1 The Argument for the Public Treasury

Krishna’s rationale was grounded in the principles of Rajdharma (royal duty) and collective welfare. He argued that an object of such immense power—capable of banishing famine, drought, and pestilence from the land where it was worshipped —belonged in the custody of the King, who represents the people.

By placing the jewel in the royal treasury, its benefits (the daily gold output and the magical protection) would be "democratized." The gold could be used to fund public infrastructure, defense, and social welfare for all citizens of Dwarka, rather than accumulating in the private vaults of Satrajit. Krishna was essentially advocating for a Centralized Gold Standard, where the reserve asset is managed by the sovereign for the stability of the currency and the nation, rather than a decentralized, private emission of money.

2.2.2 The Rejection and the Curse of Private Hoarding

Satrajit, blinded by greed and attachment (asakti), refused Krishna’s request. He installed the jewel in a private temple within his home, hiring priests to worship it solely for his own benefit. This act represents the privatization of the commons—taking a divine gift meant for the world and enclosing it.

The consequences of this refusal illustrate the "Resource Curse." The jewel did not bring peace to Satrajit; it brought paranoia and tragedy.

- The Tragedy of Prasena: Satrajit’s brother, Prasena, treating the strategic asset as a mere ornament, wore the jewel on a hunting trip. He was killed by a lion, which snatched the gem.

- The Theft by Jambavan: The lion was subsequently killed by Jambavan, the King of Bears (a character from the Ramayana era), who took the jewel to his cave to use as a toy for his son.

- The Defamation of Krishna: When Prasena did not return, Satrajit jumped to the conclusion that Krishna, having coveted the jewel, had murdered his brother to steal it. He spread this rumor throughout Dwarka, tarnishing Krishna’s reputation.

2.3 The Struggle for Recovery and Truth

To clear his name and restore the integrity of the leadership, Krishna embarked on a search mission. He tracked the jewel to Jambavan’s cave. What followed was a 28-day duel between Krishna and Jambavan—a clash between the Avatar of the current age and a relic of the previous age.

Upon realizing Krishna’s divinity, Jambavan surrendered the jewel and his daughter, Jambavati, to Krishna. Krishna returned to Dwarka and presented the jewel to Satrajit in the royal assembly, exposing the nobleman’s false accusations and clearing his own name.

2.3.1 The Failure of Private Custody Redux

Shamed, Satrajit offered his daughter Satyabhama and the jewel to Krishna as atonement. Krishna accepted Satyabhama but refused the jewel. He returned it to Satrajit, stating that it was better left with him, provided he remained pious.

Why did Krishna refuse the jewel after fighting for it? This is the crux of the democratization lesson. Krishna demonstrated that moral authority is superior to material wealth. He did not need the gold to rule; he needed trust. By returning the jewel, he showed he was not a tyrant seizing assets.

However, the story does not end happily for Satrajit. His possession of the jewel continued to incite envy. He was eventually murdered in his sleep by Shatadhanwa, a rival suitor who coveted the stone. The jewel became a "hot potato" of death.

2.4 The Final Settlement: State Custody

After Satrajit’s death and the subsequent vengeance taken by Krishna on the murderers, the jewel was not left in private hands again. It was entrusted to Akrura, a respected elder and relative, who was asked to stay in the city.

The political conclusion is clear: Gold that is not democratized—that does not serve the collective—destroys its possessor. The Syamantaka narrative serves as an ancient warning against the concentration of wealth. It posits that the stability of a nation depends on the sovereign management of its reserve assets. Krishna’s attempt to "democratize" the gold was an attempt to save Satrajit from himself and to ensure the prosperity of Dwarka—a lesson that resonates with modern debates on wealth taxation and sovereign reserves.

Chapter 3: The Ancient Gold Standards — Coinage, Regulation, and the Hundi System

The mythological frameworks of Hiranyagarbha and Syamantaka laid the philosophical groundwork for the economic systems that followed. As civilization advanced, the divine "Golden Egg" was smelted into the "Sovereign Coin," and the management of gold transitioned from the temple to the state treasury.

3.1 The Arthashastra: The Mauryan Gold Standard

The most sophisticated ancient treatise on the management of a gold-based economy is the Arthashastra, authored by Chanakya (Kautilya) around the 4th century BCE. Chanakya, the Prime Minister to Emperor Chandragupta Maurya, viewed gold not merely as a store of value but as a critical instrument of state power and regulation.

3.1.1 Standardization and the Mint

Chanakya established a rigorous system of weights and measures, which is the prerequisite for any "pegged" currency system. The Arthashastra details a bimetallic standard involving four types of coins:

- Suvarnarupa: Gold coins.

- Rupyarupa: Silver coins.

- Tamrarupa: Copper coins.

- Sisarupa: Lead coins.

The value of these coins was strictly pegged to their metallic weight. The base unit of measurement was the Raktika (or Ratti), derived from the weight of a bright red gunja seed (approx. 0.11 to 0.12 grams).

- 1 Suvarna (Gold Coin) was pegged to 80 rattis (approx. 9-11 grams).

- 1 Karshapana (Silver Coin) was pegged to 32 rattis.

Chanakya advocated for a state monopoly on minting. The Lakshanadhyaksha (Superintendent of the Mint) was tasked with maintaining the purity and weight of the coinage. Any private attempt to debase the currency or mint counterfeit coins was met with severe punishment. This created a reliable "Gold Standard" where the face value of the currency was inextricably linked to its intrinsic value, ensuring price stability across the vast Mauryan empire.

3.2 The Hundi System: Proto-Paper Currency and Trust Networks

While coins facilitated local trade, moving heavy quantities of gold across the subcontinent was risky and inefficient. To solve this, Indian merchants developed the Hundi system—a financial innovation that functions remarkably like modern paper currency or even digital transfers, but backed by gold.

3.2.1 The Mechanics of the Peg

A Hundi was an unconditional order in writing, directing a person to pay a certain sum of money to a named person. It served three functions:

- Remittance: A merchant in Delhi could deposit gold with a Saraf (banker) and receive a Hundi. He could travel to Surat and exchange that Hundi for gold, avoiding the risk of highway robbery.

- Credit: Merchants could borrow money against a Hundi, promising repayment at a later date (Muddati Hundi).

- Trade Settlement: It acted as a bill of exchange for goods.

Crucially, the Hundi had value only because it was "pegged" to the gold reserves and the reputation of the issuer. It was a derivative instrument. If the Saraf failed to honor the Hundi in physical gold upon maturity, his reputation—and the value of all his circulating Hundis—would collapse. This system relied on a decentralized network of trust among bankers, mirroring the node verification in modern blockchain systems, but rooted in social capital and gold vaults rather than cryptographic proof.

3.3 Global Parallels: The Roman and Lydian Experience

The Indian experience was part of a global trend toward metallism.

- Lydia: As noted, King Croesus’s minting of gold coins created the first "state-verified" value transfer protocol. The lion stamp on the Lydian stater was the ancient equivalent of a digital signature, certifying the coin's integrity.

- Rome: The Roman Empire’s stability was pegged to the Aureus and later the Solidus (from which we get the word "soldier" and "solid"). The Solidus was so stable it was known as the "dollar of the Middle Ages." However, when emperors like Nero began to "clip" the coins (reducing gold content to fund wars), they effectively broke the peg. This debasement led to hyperinflation and is often cited as a contributing factor to the fall of Rome.

This historical record establishes a clear precedent: civilizations thrive when their currency is honestly pegged to a scarce asset (Gold/Suvarnarupa) and collapse when that peg is broken by centralized manipulation.

Chapter 4: The Digital Resurrection — Sovereign Bitcoin Standards in 2025

We now turn to the modern era. The user asks: Is there any parallel between pegging physical sovereign currencies to gold in ancient times as the modern digital money is being tied to Bitcoin?

The answer is a resounding yes. In 2024 and 2025, we are witnessing a geopolitical phenomenon that can be described as the "Digital Resurrection of the Gold Standard." Nation-states, recognizing the fragility of fiat currencies (which are unbacked, unlike the Suvarnarupa), are beginning to peg their economic sovereignty to Bitcoin. Bitcoin is being treated not just as an asset, but as the new Hiranyagarbha—the immutable, mathematical "Golden Womb" of the digital age.

4.1 Bitcoin as Digital Gold: The Structural Parallel

The comparison is structural, not just metaphorical.

- Scarcity: Gold is scarce because of physics (nucleosynthesis). Bitcoin is scarce because of mathematics (the 21 million hard cap). Just as Chanakya could not mint more Suvarnarupas without finding more gold, a central bank cannot print more Bitcoin.

- Mining (Proof of Work): Obtaining gold requires physical effort (digging). Obtaining Bitcoin requires computational effort (hashing). This "unforgeable costliness" is what secures the value of both against arbitrary inflation.

- Sovereignty: Gold is the liability of no one. It exists independently of states. Bitcoin shares this property. It is "synthetic commodity money," resistant to censorship and seizure if held correctly.

4.2 Case Study A: El Salvador — The Volcano Standard

El Salvador is the modern Lydia. Under President Nayib Bukele, it became the first nation to adopt Bitcoin as legal tender, effectively "pegging" its internal economy to the digital standard alongside the US dollar.

4.2.1 The Volcano Bonds

In 2024 and 2025, El Salvador advanced this integration with the issuance of "Volcano Bonds."

- Structure: These are sovereign debt instruments backed by the country's Bitcoin mining operations and future Bitcoin accumulation. The bonds aim to raise $1 billion, with 50% used to purchase Bitcoin and 50% to build energy and mining infrastructure.

- The Yield: The bonds offer a 6.5% coupon. However, they also offer a "Bitcoin Dividend"—after a 5-year lockup, if Bitcoin appreciates, the profits are shared with bondholders.

- Energy as Backing: By utilizing the geothermal energy of the Conchagua volcano to mine Bitcoin, El Salvador is monetizing its geology. This is a direct parallel to the Syamantaka Jewel producing gold daily. The volcano is the jewel; the mining rig is the mechanism; Bitcoin is the output.

4.2.2 Sovereign Reserves

As of late 2025, El Salvador holds approximately 7,500 BTC. Unlike Satrajit who hoarded his wealth, El Salvador uses its Bitcoin profits to fund veterinary hospitals and schools, fulfilling Krishna’s vision of democratized wealth.

4.3 Case Study B: Bhutan — The Hydro-Electric Treasury

While El Salvador is vocal, the Kingdom of Bhutan is the quiet giant of the Bitcoin Standard, holding over 13,000 BTC (USD 780 million+) as of 2025.

4.3.1 Druk Holdings and the Green Peg

Bhutan’s sovereign investment arm, Druk Holding & Investments, has been mining Bitcoin using the country’s massive surplus of hydroelectric power.

- The Mechanism: Bhutan has rivers that generate more electricity than its population consumes. Instead of letting this energy go to waste or selling it cheaply to neighbors, they convert it into Bitcoin. This effectively pegs the Bhutanese economy to the global value of Bitcoin.

- Gelephu Mindfulness City: In December 2025, Bhutan pledged 10,000 BTC to back the development of a new "Mindfulness City". This city will function as a Special Administrative Region with its own legal framework, backed by the "hard money" of Bitcoin reserves. This mirrors the ancient city-states like Dwarka that were built around the prosperity of their treasury.

4.4 Case Study C: The United States Strategic Bitcoin Reserve

The most transformative development occurred in 2025 with the United States' pivot toward a Strategic Bitcoin Reserve.

4.4.1 The 2025 Executive Order

In March 2025, the U.S. government formalized the "Strategic Bitcoin Reserve and United States Digital Asset Stockpile" via executive order.

- The Shift: Historically, the U.S. Marshals auctioned off seized Bitcoin (e.g., from Silk Road). The new policy mandates the retention of these assets. The U.S. holds approximately 328,000 BTC, making it the largest sovereign holder in the world.

- The "BITCOIN Act": Legislative proposals like Senator Lummis’s "BITCOIN Act" envision the U.S. acquiring up to 1 million BTC (5% of total supply) to be held for 20 years as a hedge against national debt and dollar devaluation.

This is the "Digital Fort Knox." Just as the U.S. dollar’s dominance in the 20th century was partly due to the vast gold reserves held at Bretton Woods, the 21st-century dominance may depend on holding the largest share of the Bitcoin network.

4.5 Counter-Example: The Failure of Zimbabwe’s ZiG

To understand why the Bitcoin peg is working while other "backed" currencies fail, we must look at Zimbabwe’s "ZiG" (Zimbabwe Gold) currency, introduced in 2024.

4.5.1 The Trust Paradox

The ZiG was a digital token backed by physical gold reserves in the central bank. Theoretically, this is the Suvarnarupa reborn. However, by early 2025, the ZiG had lost 90% of its value.

- Why? Because the market did not trust the custodian. A gold-backed currency requires trust that the gold is actually there and that the government won't print more tokens than gold. Zimbabwe’s history of hyperinflation destroyed that trust.

- The Lesson: A peg to a physical asset fails if the verifier (the state) is corrupt. Bitcoin succeeds because the verifier is code. El Salvador and Bhutan succeed because they hold the asset (Bitcoin) that verifies itself, rather than issuing a paper promise backed by a hidden vault.

Chapter 5: Synthesis — The Eternal Cycle of Hard Money

5.1 The Return to Dharma

The ancient concept of Dharma implies righteousness and cosmic order. In economics, Dharma manifests as "honest money"—money that cannot be debased by the whims of a ruler.

- Hiranyagarbha established gold as the divine standard—immutable and eternal.

- Krishna fought to ensure this standard served the people, not the hoarder.

- Chanakya codified this into law with the Suvarnarupa.

- Satoshi Nakamoto (the pseudonymous creator of Bitcoin) reintroduced this Dharma through code.

The fiat experiment (approx. 1971–2025) was an aberration—a period of Adharma where money could be printed without cost. The return to the Bitcoin Standard is a return to the ancient wisdom of the Rigveda: that value must be rooted in something finite, costly, and universal.

5.2 Table: The Evolution of the Sovereign Peg

| Feature | Vedic/Mauryan Era (Gold Standard) | Modern Digital Era (Bitcoin Standard) |

|---|---|---|

| Origin of Value | Divine (Hiranyagarbha / Sun) | Mathematical (Cryptography / Energy) |

| Source of Scarcity | Geological rarity | Algorithmic Hard Cap (21 Million) |

| Mechanism of Creation | Mining (Physical Labor) | Mining (Proof of Work / Hashing) |

| Storage of Value | Vaults / Temple Treasuries | Cold Storage / Multi-Sig Wallets |

| Transfer Mechanism | Hundi (Paper backed by Trust) | Lightning Network (Digital backed by Code) |

| Sovereign Strategy | Accumulation for Stability (Arthashastra) | Strategic Reserve (US/Bhutan/El Salvador) |

| Greatest Threat | Debasement / Theft (Syamantaka) | Private Key Loss / 51% Attack |

| Philosophical Goal | Amrita (Immortality of Wealth) | Censorship Resistance / Sovereign Freedom |

5.3 Conclusion

The story of gold is a circle. It began with the Golden Womb (Hiranyagarbha) floating in the void, birthing the universe. It evolved into the Syamantaka Jewel, where Lord Krishna taught us that the power of wealth must be democratized for the common good. It was standardized by kings like Croesus and Chandragupta, who pegged their empires to its luster.

Today, that story continues in the digital realm. The "miners" of Bhutan and Texas are the new alchemists, transmuting energy into the "digital gold" of Bitcoin. The "Strategic Reserves" of 2025 are the new Dwarka Treasuries. The medium has changed—from heavy metal to weightless code—but the fundamental human need remains the same: a search for a truth that cannot be inflated, a value that cannot be corrupted, and a standard that endures beyond the lifespan of kings and empires. The Hiranyagarbha has hatched again, this time on the blockchain.

Data Tables and Statistics

Table 2: Sovereign Bitcoin Holdings (Estimated 2025)

| Country | Holdings (BTC) | Valuation (Approx. USD 90k/BTC) | Source of Acquisition | Strategic Purpose |

|---|---|---|---|---|

| United States | ~328,000 | ~USD 29.5 Billion | Seizures / Strategic Retention | National Reserve / Debt Hedge |

| China | ~190,000 | ~USD 17.1 Billion | Seizures (PlusToken) | State Control (Unofficial Reserve) |

| United Kingdom | ~61,000 | ~USD 5.5 Billion | Seizures | Treasury Asset |

| Ukraine | ~46,000 | ~USD 4.1 Billion | Donations / Seizures | War Financing / Defense |

| Bhutan | ~13,000 | ~USD 1.2 Billion | Mining (Hydro-power) | Sovereign Wealth / Development |

| El Salvador | ~7,500 | ~USD 675 Million | Direct Purchase | Legal Tender / Independence |

Note: Data derived from snippet and. Valuations fluctuate with market price.

Table 3: The Physics of Value - Gold vs. Bitcoin

| Property | Gold (The Ancient Standard) | Bitcoin (The Digital Standard) |

|---|---|---|

| Fungibility | High (Melting required) | High (UTXO model) |

| Divisibility | Low (Difficult to divide dust) | High (1 BTC = 100,000,000 Satoshis) |

| Portability | Low (Heavy, expensive to ship) | High (Send billions instantly) |

| Verifiability | Difficult (Requires assay/smelting) | Instant (Run a node) |

| Scarcity | Unknown (Space mining possible) | Known (Fixed at 21,000,000) |

| Censorship Resistance | High (Physical possession) | High (Cryptographic possession) |

| Mythological/Origins | Hiranyagarbha (Cosmic Egg) | Genesis Block (Satoshi) |

Web links

-

Unearthing the Rich History of Gold as Currency Through Ages - Boonit Online Pawnbroking

-

How Gold became the standard for monetary systems - Phoenix Refining

-

KB 2-1 / The Story of the Syamantaka Jewel KRSNA, The Supreme Personality of Godhead

-

The Syamantaka Jewel story from the Krishna book. - Blog - ISKCON Desire Tree | IDT

-

Five Lessons From The Syamantaka Jewel Story - Krishna's Mercy

-

Chanakya's Economic Doctrine: Insights from the Arthashastra - IJFMR

-

Maurya Period Coins - Ancient Coins - Ancient History Notes - Prepp

-

Historical Traces of Hundi, Sociocultural Understanding, and Criminal Abuses of Hawala

-

How a Bitcoin System Is Like and Unlike a Gold Standard | Cato at Liberty Blog

-

Central Banks, Gold, and Bitcoin: Redefining Money in the 21st Century

-

El Salvador Volcano Bond to be issued in the first quarter of 2024 - InvestinElSalvador

-

The First 1 Billion USD Bitcoin Volcano Bond is Here | by Nomadic Money - Medium

-

El Salvador Set To Launch Bitcoin Bonds | by Wheatstones | Coinmonks - Medium

-

[El Salvador's USD 1bn volcano-powered Bitcoin bonds greenlit for launch in early 2024](https://www.dlnews.com/articles/markets/el-salvador-bitcoin-volcano-bonds-set-to-launch-in-early-2024/ 36. Cryptocurrency Reserve by Country (2025): Who Has a Crypto National Reserve and Who Holds the Largest? - Bleap, https://www.bleap.finance/blog/cryptocurrency-reserve-by-country)

-

El Salvador's Bitcoin Bond is Finally Here! - LARC @ Cardozo Law

-

Government Bitcoin Holdings in 2025: Who Owns the Most? | Coinpedia Fintech News on Binance Square

-

Bhutan commits USD 900M in digital assets for Mindfulness City - CoinGeek

-

Establishment of the Strategic Bitcoin Reserve and United States Digital Asset Stockpile